If you’re new to real estate, most beginner guides push one path: buy a rental or house hack. That’s a solid start, but it’s not the only way to build momentum.

In Albuquerque, different neighborhoods, price points, and housing stock create room for multiple beginner-friendly strategies: flipping, BRRRR, wholesaling, and creative finance like seller financing. The key is matching a strategy to this market and you, not a generic playbook.

This guide is built for Albuquerque real estate investing beginners who want more options, clearer risks, and practical next steps.

Albuquerque Market Snapshot: What the Data Suggests for Investors

Before choosing a strategy, ground yourself in what the local market is doing.

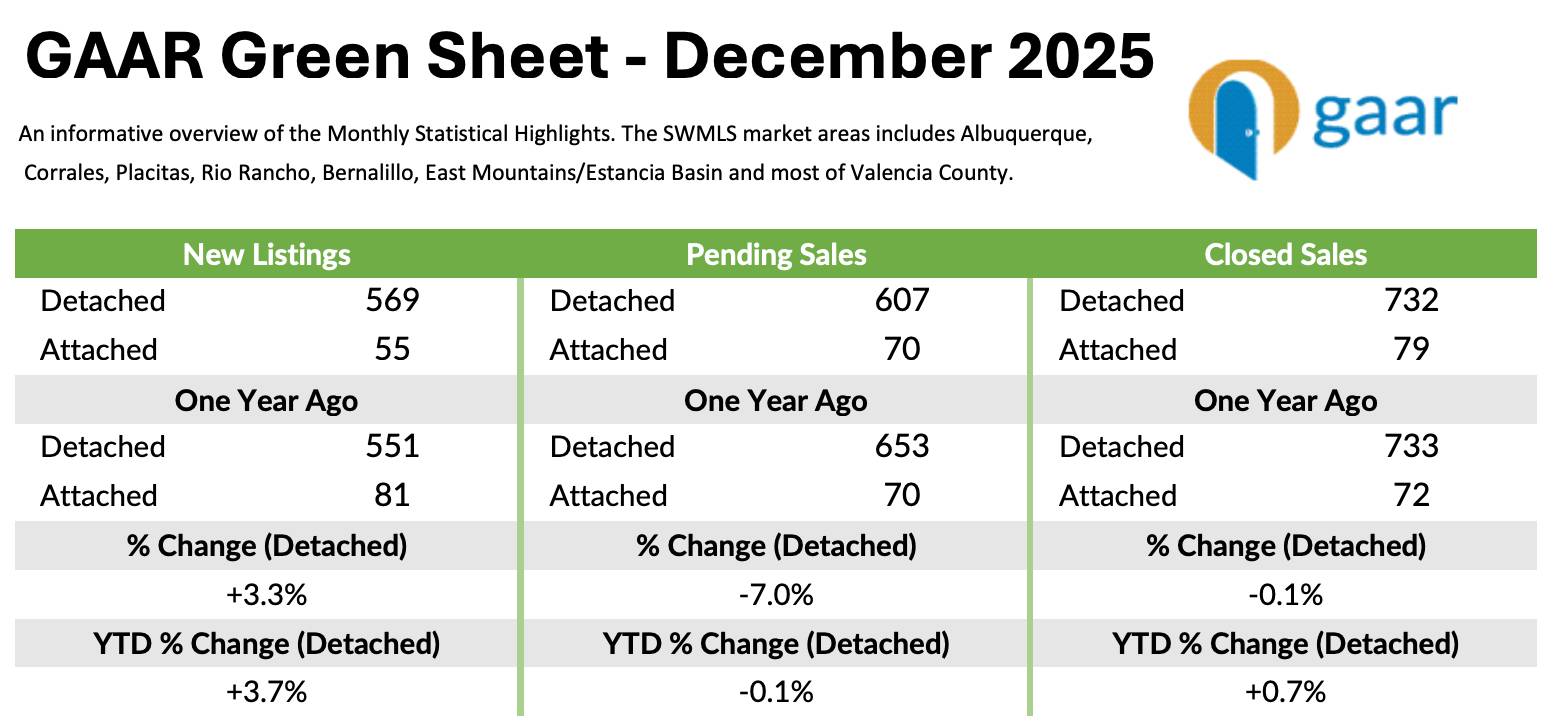

GAAR’s 2025 annual stats for single-family detached homes show:

- Closed sales: 9,820 (up 2.08%)

- Inventory: 11,706 (down 7.20%)

- Median price: $370,000 (up 2.78%)

- Price per sq ft: $213.81 (up 2.66%)

- % of list price received: 98.3%

And in the most recent monthly reporting available (December 2025), GAAR notes pending sales rose for detached homes, and inventory increased year-over-year.

Investor takeaway: Albuquerque can reward smart buying (especially on value-add deals), but you still need conservative numbers, especially for flips, where margin gets tight when buyers aren’t overbidding.

Strategy 1: Fix-and-Flip in Albuquerque

Flipping is simple in concept: buy under market value, renovate to add value, then sell to an end buyer.

Where flips tend to make sense locally

In Albuquerque, flips often pencil best where:

- Homes are dated but in stable, in-demand neighborhoods

- There’s strong retail-buyer demand for “move-in ready”

- You can avoid major layout changes and focus on high-ROI updates

Practical neighborhood lens (general patterns you’ll see in ABQ):

- NE Heights / Uptown areas: buyers often pay for turnkey condition

- Westside: tends to favor clean, modern updates and functional floorplans

- Parts of the South Valley / older pockets citywide: can work if you’re experienced with rehab scope and comps variability

Beginner flip rule: margins must be real

Flips can look amazing on paper and fall apart with one surprise (roof, sewer, foundation, permitting delays). If you’re new:

- Build in a bigger contingency

- Use conservative ARV comps (recent, similar, close)

- Plan for longer days on market than “hot market” assumptions

(You’ll also want a contractor bid before you remove inspection contingencies whenever possible.)

Strategy 2: BRRRR (Value-Add Rental) A Hybrid Beginner Strategy

BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat. The idea is to force appreciation through rehab, then refinance based on the improved value.

Why BRRRR can fit Albuquerque:

- Plenty of homes have “cosmetic dated” upside

- Refinancing can recycle capital if the appraisal supports your new value

- You’re not relying solely on timing a retail resale

Beginner-friendly BRRRR tip: Treat refinance proceeds as a bonus, not a guarantee. Appraisals and lending terms can be tighter than expected.

Strategy 3: Wholesaling (Do It the Right Way)

Wholesaling is essentially finding a deeply discounted deal and assigning or reselling the contract to another buyer for a fee. Seasoned investors often discuss the importance of clear paperwork, contingencies, and proper closing support.

Important reality check (especially for beginners): wholesaling is heavily dependent on legal compliance and disclosure. Rules can vary by state and change over time, so in New Mexico, this is one where you should talk to a New Mexico real estate attorney and follow NMREC/GAAR guidance before attempting it.

If you want “creative” without the compliance risk, consider partnering with:

- A licensed agent + attorney-reviewed templates

- A local investor with a proven transaction process

- A title company that can explain how assignments/double closes work in practice

Strategy 4: Creative Financing

Creative finance can help beginners get started when traditional financing feels limiting, but it requires strong documentation and clear expectations.

Seller financing/owner carry

With seller financing, the seller acts like the bank, and you pay them over time. We see seller financing as a way to navigate rate environments, but emphasize clarity on terms and protections.

Local use case: seller financing can appear in Albuquerque when:

- A home is free and clear

- The seller wants predictable monthly income

- The property is harder to sell traditionally (condition, uniqueness, timeline)

Beginner tip: Always use an attorney-reviewed promissory note and deed of trust/mortgage structure appropriate for New Mexico.

“Passive” alternatives (good for true beginners)

If you want exposure without managing tenants or renovations, approaches like REITs and other real-estate investment vehicles are valid strategies for beginners.

These aren’t “Albuquerque-only,” but they’re a legitimate way to start building investing habits while you learn the local market.

How to Choose Your Best Beginner Path in Albuquerque

Ask yourself these three questions:

1) Do you want cash now or wealth later?

- Flips can create chunks of cash (higher risk)

- Rentals/BRRRR build long-term wealth + tax advantages

2) How much time do you actually have?

- Flips + BRRRR = project management

- Rentals = ongoing management

- Passive options = minimal time, less control

3) What’s your risk tolerance?

As some active investors have publicly discussed recently, some are shifting away from flips in cooler conditions and leaning into longer-term hold strategies when resale timing is riskier.

That doesn’t mean “don’t flip” it means your buy price and margins matter even more.

First Steps Checklist for Albuquerque Real Estate Investing

Here’s a clean starter plan for first-time real estate investors Albuquerque:

- Pick one strategy (flip, BRRRR, rental, or creative finance)

- Choose two target areas you can learn deeply

- Track 10-20 recent sold comps weekly (same size/style)

- Build a “deal analyzer” with conservative assumptions

- Assemble your core team: lender, agent, contractor, title, attorney

This is how Albuquerque real estate investing becomes repeatable, not random.

CTA: Want a Local Deal Reality Check?

If you’re exploring Albuquerque real estate investing and want a second set of eyes on neighborhoods, comps, or a flip vs. BRRRR decision, the Better with Baron team can help you pressure-test the numbers with local context, no pressure, just practical guidance.