If you’re asking, “How much do I need to make to buy a house in Albuquerque?”, you’re asking the right question.

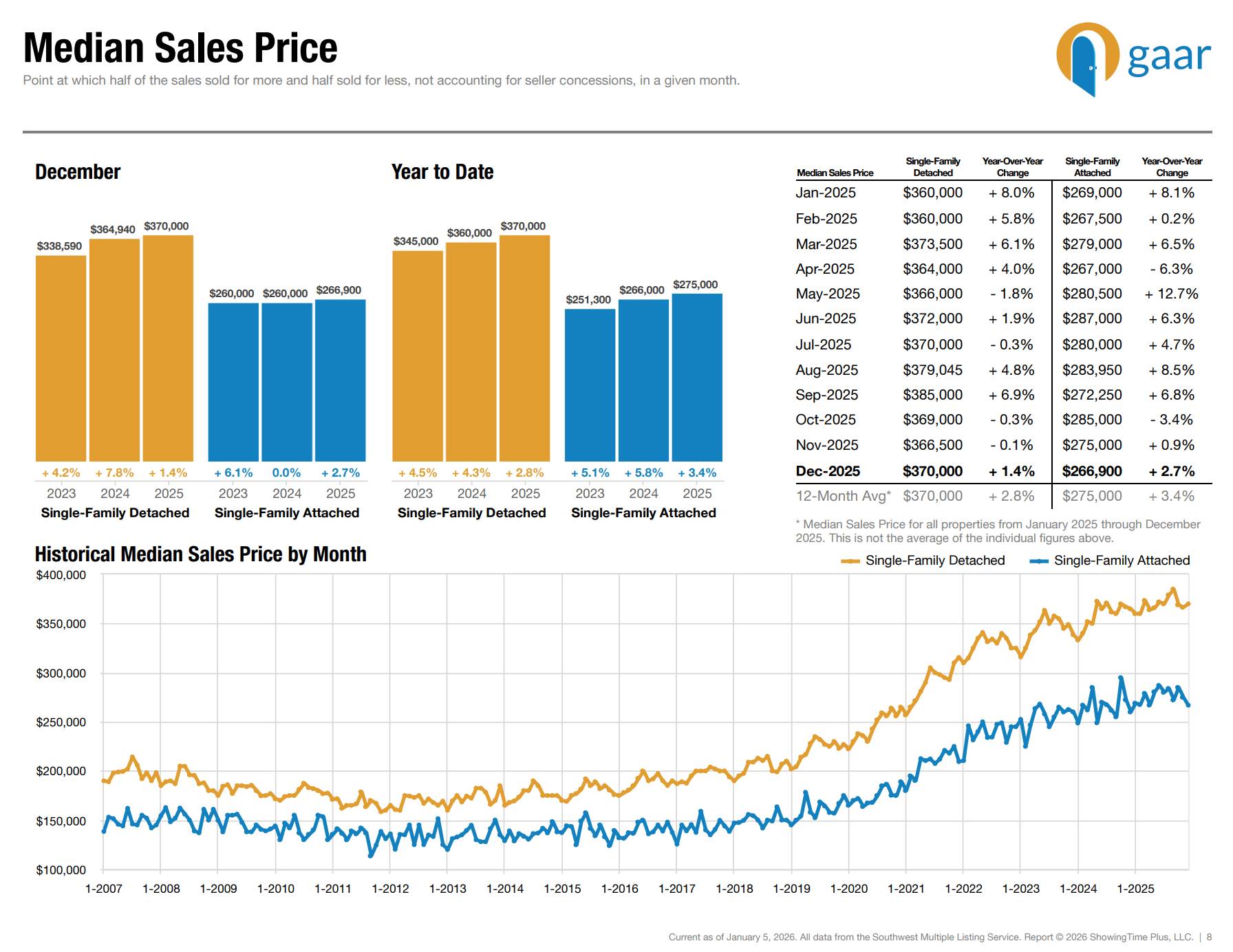

According to the most recent data from the Greater Albuquerque Association of REALTORS® (GAAR), the median home price in the Albuquerque metro area is now $370,000. That number matters because your required income is directly tied to current pricing.

The good news? Albuquerque remains more affordable than many Southwestern markets, but buying today requires a clear understanding of payments, rates, and debt. Let’s walk through real numbers based on the current median price.

What Does a $370,000 Home Payment Look Like?

When you ask us,” How much do I need to make to buy a house in Albuquerque?”, we start with a realistic payment estimate.

Scenario 1: 5% Down on $370,000

- Purchase price: $370,000

- 5% down: $18,500

- Loan amount: $351,500

- Interest rate example: 6.5% (for illustration; rates vary daily)

- Includes taxes, insurance, and PMI

Estimated monthly payment:

- Principal & interest: ~$2,110

- Taxes & insurance: ~$400–$500

- PMI: ~$120–$170

- Estimated total payment: $2,630–$2,780 per month

Estimated total payment: $2,750–$2,900 per month

This is a realistic Albuquerque mortgage payment estimate for a median-priced home right now.

How Much Income Is Needed at Today’s Median Price?

Most lenders use the 28% housing ratio guideline. That consists of Housing payment ÷ 28% of gross monthly income. Let’s see what this looks like with a $2850 monthly payment.

Using a $2,850 payment:

$2,850 ÷ 0.28 = $10,178/month gross income

That equals approximately:

$122,000 per year household income

This assumes:

- Average debt levels

- Solid credit

- Conventional financing

The income needed to buy a home in Albuquerque increases as prices rise, and the updated $370,000 median reflects that shift.

What If You Put 20% Down?

Now let’s look at the same $370,000 home with 20% down.

Scenario 2: 20% Down

- Down payment: $74,000

- Loan amount: $296,000

- No PMI

Estimated payment:

- Principal & interest: ~$1,875

- Taxes & insurance: ~$400–$500

Total: $2,300–$2,400 per month

Using the 28% rule:

$2,350 ÷ 0.28 = $8,392/month gross income

Annual income needed:

$100,700 per year household income

This shows how significantly a down payment impacts qualification and your monthly payment.

Can You Buy Below the Median?

Yes, and many buyers do.

The median is the midpoint of all sales. That means half of the homes sold for less than $370,000.

Opportunities under the median are often found in:

- Parts of the Westside

- Certain Northeast Heights pockets

- South Valley

- Rio Rancho

- Homes needing cosmetic updates

For example:

$325,000 Purchase Example

5% down

Estimated payment: ~$2,400–$2,500

Income needed:

$2,450 ÷ 0.28 = ~$8,750/month

≈ $105,000 per year household income

Still significant but more attainable for many dual-income households.

How Debt and Credit Change the Equation

When clients ask, “How much do I need to make to buy a house in Albuquerque?”, income is just one part of the equation.

Your approval amount also depends on:

- Car loans

- Student loans

- Credit card balances

- Child support or other obligations

Lenders also consider total debt-to-income (DTI), typically capped at around 36-45% depending on loan type.

Credit score plays a major role as well. A higher score often means:

- Lower interest rate

- Lower monthly payment

- Lower required income

A 0.5% rate difference on a $350,000+ loan can change payments by $100 -$200 per month, which can shift required annual income by $5,000-$8,000.

For many first-time home buyer Albuquerque clients, improving credit before shopping creates more flexibility than increasing income.

How Does Albuquerque Compare Regionally?

Even with a $370,000 median, Albuquerque home prices in 2026 remain lower than many comparable markets:

- Denver

- Phoenix

- Salt Lake City

- Austin

While we’ve seen steady appreciation, GAAR data shows a more normalized pace compared to 2021-2022. Inventory levels have also improved slightly compared to the extreme shortages of previous years.

That shift allows buyers to negotiate more thoughtfully rather than rushing. Buying a house in Albuquerque, NM, is still more attainable than in many surrounding metro areas, but preparation matters.

What Really Determines If You’re Ready?

Instead of asking only, “How much do I need to make to buy a house in Albuquerque?”, consider these readiness factors:

- Two years of steady employment

- Stable monthly income

- Savings for down payment + closing costs (2–4% of purchase price)

- Emergency reserve after closing

- Manageable debt

We’ve worked with buyers earning:

- $85,000 dual income

- $95,000–$110,000 households

- $120,000+ combined income

Each scenario is different based on debt, credit, and goals.

A Smarter First Step Than Guessing

Stop guessing and get a clear answer. Your required income depends on your specific credit, debt, and down payment. The best first step is a no-obligation pre-qualification with a lender. This process gives you your real buying number. Check out our first-time buyer home guide!

Final Answer: Income Needed at a $370,000 Median

For today’s Albuquerque median home price of $370,000:

- With 5% down: around $120,000–$125,000 household income

- With 20% down: around $100,000–$105,000 household income

- Lower-priced homes may require less

These are estimates your exact number depends on your financial profile.

Thinking About Buying in 2026?

If you’re wondering what your real number is, not a generic calculator result, we can help you run neighborhood-specific scenarios in:

- Northeast Heights

- Westside

- Nob Hill

- Rio Rancho

- South Valley

We’ll walk through realistic payments, lender options, and what makes sense for your goals clearly and without pressure. Buying starts with clarity.